malaysia income tax 2018

Calculations RM Rate TaxRM A. Last reviewed - 13 June 2022.

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and.

. However the income tax of non-residents is calculated on a three-step tax rate 27 15 and 10 depending on the. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are.

The income is classified into 8 different tax groups ranging from 0 to 26. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce.

Tax Brochure 2018. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. In addition under the new tax regime the maximum penalty would be reached within 90 days instead of.

Income Tax 20182019 Malaysian Tax Booklet 9 Basis of assessment Income is assessed on a current year basis. Nonresident individuals are taxed at a flat rate of 28. The Inland Revenue Board of Malaysia achieved a new record in direct tax collection last year with RM137035 billion collected which is 1113 or.

Introduction Individual Income Tax. The year of assessment YA is the year coinciding with the calendar year. Corporate - Taxes on corporate income.

Foreign source income however when received in Malaysia by a resident company. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. The MITA taxes income accrued or derived from Malaysia or received in Malaysia from outside Malaysia.

For both resident and non-resident companies corporate income tax CIT is imposed on income. On the First 5000. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the.

On the First 5000 Next 15000. If taxable you are required to fill in M Form. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

A 40 late payment penalty of tax due will be imposed instead of the previous 50. The Tax tables below include the tax. What is the income tax rate in Malaysia.

Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. KUALA LUMPUR Jan 20. Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Highlights 3 2 Review of Group Relief a It is proposed that the transfer of adjusted losses to a.

Tax Brochure 2017. Tax Rate of Company.

Tax 467 March 2019 Question 1 Mr Noah An American Citizen Was Employed As A Dentist By My Dental Studocu

How To Read And Understand Your Form W 2 At Tax Time

Corporate Tax Rates Around The World Tax Foundation

Oecd Tax Al Twitter Revenues From Taxes On Goods And Services Played A Major Role In Economies In The Region Particularly In The Pacific Revenue From Other Taxes On Goods And

Comparing Tax Rates Across Asean Asean Business News

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

Pressure To Raise Taxes Anticipated The Star

The Differences Between Income Tax Act Public Rulings And Pu Order Legally Malaysians

Understanding Tax Smeinfo Portal

Malaysia Taxation Of Cross Border M A Kpmg Global

Snapshot Of Asean Tax Rates Htj Tax

Oecd Tax On Twitter Two Thirds Of Economies Included In The Revstatsap Report Increased Their Tax To Gdp Ratios Between 2017 And 2018 Nauru Tokelau And Mongolia Achieved The Largest Increases Https T Co H8jprbvwoc Twitter

Comparing Tax Rates Across Asean Asean Business News

Richest 1 In New York Earning 133 Billion Will Devastate City If They Leave Bloomberg

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

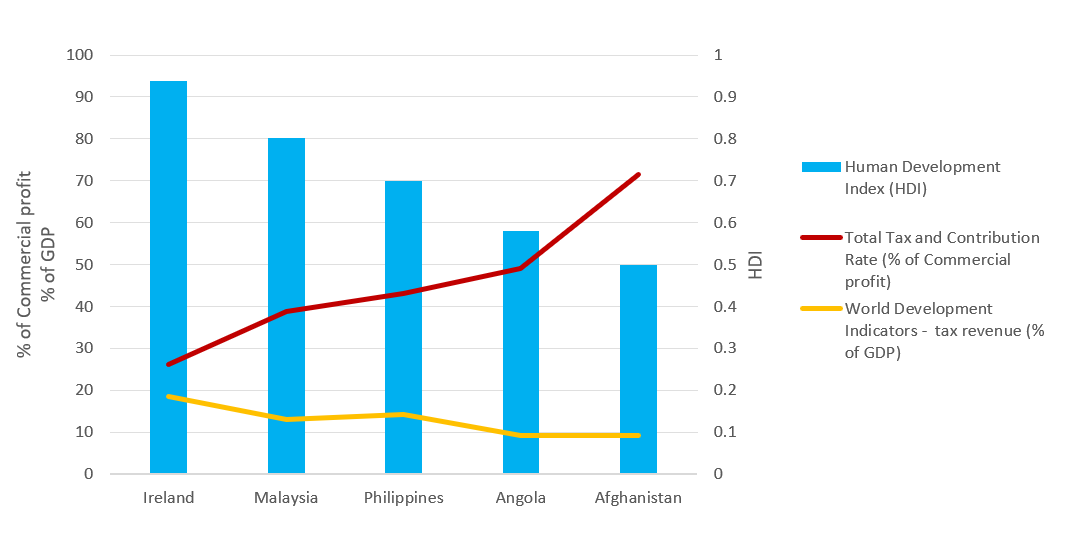

Why It Matters In Paying Taxes Doing Business World Bank Group

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Comments

Post a Comment